Some Eagle County residents will see slight declines in their property taxes payable in 2023

But expect some big increases in assessed values coming in 2023

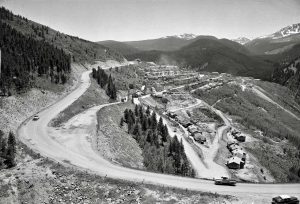

Chris Dillmann | Daily archive photo

As the state’s formulas change for property valuation and taxation, some of Eagle County’s taxing districts are seeing slight declines in their mill levies and estimated revenues. But more changes are expected for 2024.

Here’s a brief look at gross revenue estimates for some of Eagle County’s taxing districts:

- Cordillera Mountain Metropolitan District: $569,993 less than 2022

- Bachelor Gulch Metropolitan District: $990,557 less than 2022

- EagleVail Metropolitan District: $114,381 more than 2022.

- Buckhorn Valley Metropolitan District #2: $44,558 more than 2022.

The boards of the county’s dozens of taxing districts set mill levies for the following year, but those numbers need to be certified and sent to the state by county commissioners.

The tax bills payable in 2023 are based on 2022 values.

The mill levy reports first go through the Eagle County Assessor’s Office. That office re-appraises and revalues commercial, residential and other properties in the county every other year.

Some of the changes are due to state-imposed changes in the rates at which property is taxed.

Support Local Journalism

Several of those changes reduced assessment rates for several classes of property. Those changes came in the wake of changes to the state’s 1982 Gallagher amendment, which set the ratio of property taxes paid by residential and commercial property owners. The amendment mandated that residential property make up no more than 45% of the state’s total property tax revenue.

Because residential property expanded more quickly than commercial, the assessment rate fell over the years, while the non-commercial rate increased.

State voters in 2020 approved an amendment to repeal Gallagher, after which the Colorado legislature got to work resetting assessment rates.

Assessment rates for some commercial categories have declined, as have some residential categories.

Eagle County Assessor Mark Chapin said more changes are likely to come from the 2023 session of the Colorado legislature.

Chapin said the county’s total assessed value has probably gone down a bit due to legislative changes. That’s because a mill levy is actually a percentage of a property’s assessed value. As assessment rates have declined, revenues from mill levies may also decline. But some taxing districts have also either reduced or increased their mill levies to set revenue.

As a result, some of the county’s taxing districts — most of which rely almost entirely on property tax revenue — will receive less revenue in 2023 than in 2022.

For instance, a mill levy decline for the EagleVail Metropolitan District will result in about $114,000 less revenue in 2023.

The county’s school districts account for the biggest share of a property tax dollar — about 40% on average. Eagle County’s total share of that dollar is just less than 13%.

While some tax bills payable in 2023 will decline, big changes are coming for taxes due in 2024.

The Assessor’s Office in May of next year will send notices of value to property owners. Those values are set in a “snapshot” of values as of June 30 of the prior year.

The coming increase will be substantial.

“It’s inflation like I haven’t seen in my time in office,” Chapin said. Looking at ways to soften that blow will likely draw legislative attention, he added.

What that does to tax bills payable in 2024 is up to the boards of all those districts.